Avalara provides software for automated tax compliance, across the U.S. and abroad. Avalara can automatically determine taxability, tax rates and tax jurisdictions for all sales, and will properly calculate eligible tax exemptions for specific items and services that you sell.

FOURA is natively integrated with Avalara starting with version 1.2.4.4, so once you have an Avalara account, all you need to do in FOURA is enter your account information on the Avalara Setup form and check the box to enable Avalara. When Avalara is enabled you will see additional options appear on many FOURA forms and workflow actions where Avalara is integrated.

FOURA is certified with Avalara for Address Validation, Sales Tax and Refunds.

Tip: On any form in FOURA where you see the Avalara button (  ), this indicates that there is an Avalara action available. Mouse over this button to display a tooltip describing what the action will do.

), this indicates that there is an Avalara action available. Mouse over this button to display a tooltip describing what the action will do.

Avalara calculates tax rates using the ship-from and ship-to addresses for each sale. To help make sure these addresses are correct, Avalara provides an address validation service. This service compares your address to a list of USPS validated addresses and tries to find the best match. FOURA can validate Customer Billing Addresses, Supplier Addresses and Ship-To Addresses. Address validation is limited to US and Canada only.

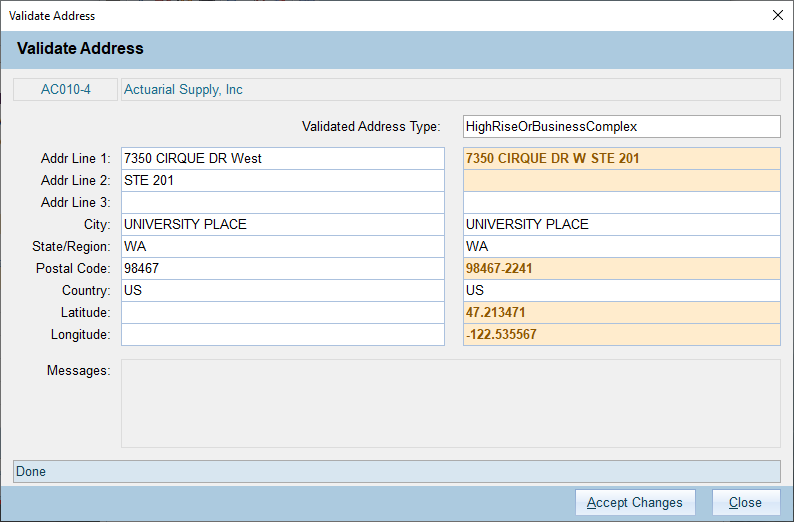

To validate an address, click the Avalara icon in a Customer, Supplier or Ship-To Address. Whenever an address is validated, the results will be displayed in a form similar to the following:

Any validated address fields with a recommended change will appear with a yellow highlight. Click Accept Changes if you want to apply these changes to the address. If you don't want these changes then simply close the validation form without clicking Accept.

If there are any errors during validation these will be displayed in the Messages section of the form, along with a detailed description. Please refer to the Avalara help page to find out more information: Troubleshoot Address Validation Errors in AvaTax

After a ship-to address is validated and you Accept Changes, the Address Entry form will show a green check and the Validated Address Type to the right of the Validated label at the bottom of the form. If you subsequently change any of the address fields, then the address will be un-validated and you will need to re-validate.

FOURA supports using coordinates for ship-to addresses. This can be helpful when your address is not registered in the USPS database, such as an open plot of land, or an intersection. The Address Validation service only works for addresses, not coordinates, but coordinates can be used for tax calculation purposes.

To use coordinates for tax enter a Latitude and Longitude, then check the "Use Coords for Tax" checkbox on the Address Entry form. You will still need to enter something in the Address field, but this can simply be a description such as "Undeveloped Land" or "Intersection of 5th and Main". The descriptive address will be displayed on any printed reports, and the coordinates will be used to identify the exact location for tax purposes.

Avalara provides sales tax calculations on a per-line basis, including detailed jurisdiction determination by address (or coordinates) and rate calculations that include jurisdiction-specific exceptions for specific types of products. Avalara can also report taxes to the appropriate jurisdictions.

FOURA support sales tax integegration for Quotes, Sales Orders and Sales Invoices. Only Sales Invoices are saved and reportable in Avalara. Quotes and Sales Orders will only calculate tax.

FOURA can internally calculate tax rates using the zip code of the address that you are selling to. These rates are displayed on the document "Tax" tab and are used to provide a rough tax calculation. This level of tax calculation is available to all FOURA customers, even those who are not currently using Avalara. For FOURA cloud customers, the Zip Codes table is updated monthly with current rates.

Zip Code tax calculations include rates and amounts for the State Tax, Country Tax and City/Local/Special Tax, as well as whether shipping and handling is taxable.

The concept of Nexus is critical for the Avalara tax calculations. Per Avalara - "Sales tax nexus is the connection between a seller and a state that requires the seller to register then collect and remit sales tax in the state. Certain business activities, including having a physical presence or reaching a certain sales threshold, may establish nexus with the state." Please refer to Avalara for more information: What is sales tax nexus?

When setting up your company in Avalara, you must specify where your company should collect sales tax. This should be done before you enable Avalara integration in FOURA.

Avalara uses tax codes to identify products that have specific tax rates depending on where they are taxed. In FOURA, the tax code is set per item/service from the Products tab on the Item Master form. To get the best results from Avalara you should set the tax code for each item/service that you sell.

FOURA includes a searchable list of Avalara Tax Codes. To view this list use Menu Code ATC, or click the Tax Codes button on the Accounting/Finance->Support menu. Please refer to Avalara for more information: Avalara tax codes.

Entity/Use codes are the tax exemption reasons that are used by Avalara. In FOURA, you can assign a default Entity/Use Code for each customer on the Customer Entry form. When creating a Quote, Sales Order or Sales Invoice the customer's default entity/use code is set on the Tax tab of the sale document. You can override the entity/use code from the document Tax tab if needed for a specific sale.

The following codes are defined:

| Code | Name | Valid Countries |

|---|---|---|

| A | FEDERAL GOV | US |

| B | STATE GOV | US |

| C | TRIBAL GOVERNMENT | * |

| D | FOREIGN DIPLOMAT | * |

| E | CHARITABLE/EXEMPT ORG | * |

| F | RELIGIOUS ORG | * |

| G | RESALE | * |

| H | AGRICULTURE | * |

| I | INDUSTRIAL PROD/MANUFACTURERS | * |

| J | DIRECT PAY | * |

| K | DIRECT MAIL | * |

| L | OTHER/CUSTOM | * |

| M | EDUCATIONAL ORG | * |

| N | LOCAL GOVERNMENT | US |

| P | COMMERCIAL AQUACULTURE | CA |

| Q | COMMERCIAL FISHERY | CA |

| R | NON-RESIDENT | CA |

| TAXABLE | NON-EXEMPT TAXABLE CUSTOMER | * |

It is possible that some or all of your customers are tax exempt, in which case you may not need to collect tax when selling to them. You can set a customer as Tax Exempt for ALL sales by checking the "Tax Exempt" checkbox on the Customer Entry form. If the customer is only Tax Exempt in a specific State/Region, then you can use the Certs button on the Customer Entry form to enter a list of States/Regions where you do not need to collect tax because the customer has a Resale Certificate.

When you create a new Quote, Sales Order or Sales Invoice then the Tax Exempt checkbox for that document will be cleared if the customer is Tax Exempt overall or if they have a non-expired resale certificate for the State/Region that you are shipping to. You can override the Tax Exempt status of a specific document by checking or unchecking the Tax Exempt checkbox on the Tax tab for that document.

When a document is marked Tax Exempt, no tax will be charged and Avalara will return $0 for the tax amount for all lines.

All Tax related settings can be managed from the Tax tab in the address section of the document. Initial values will be set based on the customer and ship to address. You can override the default values for a specific document if needed.

The following Tax settings are available:

| Setting | Description |

|---|---|

| State Sales Tax | State sales tax percentage. Initially set based on the zip code of the ship to address. This value is used to calculate the State sales tax amount on each taxable line while you are editing the document. |

| County Sales Tax | County sales tax percentage. Initially set based on the zip code of the ship to address. This value is used to calculate the County sales tax amount on each taxable line while you are editing the document. |

| City/Local Sales Tax | City, Local and Special tax percentages combined. Initially set based on the zip code of the ship to address. This value is used to calculate the City sales tax amount on each taxable line while you are editing the document. |

| Total Rate | The sum of the State, County and City/Local sales tax rates. |

| Tax Exempt | When checked, this indicates that this sale is tax exempt and no tax should be charged. This value is initially set based on the Customer's Tax Exempt and Resale certificate status for the ship to State. Avalara will return $0 for the tax amount on each line when the sale is tax exempt. |

| Tax Freight | When checked, this indicates that freight is taxable for this ship to address. (Sales Order and Sales Invoice only) |

| Tax Entity/Use Code | The tax entity/use code that describes why this sale is tax exempt. This value should be set for all tax exempt documents. Leave this blank or select TAXABLE for taxable sales. The initial value is the Customer's Tax/Entity Use code. |

| Tax Date | The date to use for tax purposes, when it is different from the document date. (Sales Invoice Only) |

When Avalara Integration is enabled, by default FOURA will use Avalara to calculate exact tax amounts for each line when the Quote is released. While the Quote is a Draft or is being Revised, an estimate of the tax amount will be calculated using the tax rates that are set on the Tax tab for the document.

When you Release the Quote, if the "Send to Avalara" box is checked then the Quote will be sent to Avalara for tax calculation purposes only. Quotes will not be saved by Avalara and will not be included in any Avalara tax reports. If you do not want Avalara to calculate taxes for the quote then you can uncheck the "Send to Avalara" check box.

Similar to Quotes, when Avalara integration is enabled then by default FOURA will use Avalara to calculate exact tax amount for each line when the Sales Order is released. While the Sales Order is a Draft or is being Revised, an estimate of the tax amount will be calculated using the tax rates that are set on the Tax tab for the document.

When you Release the Sales Order, if the "Send to Avalara" box is checked then the Sales Order will be sent to Avalara for tax calculation purposes only. Sales Orders will not be saved by Avalara and will not be included in any Avalara tax reports. If you do not want Avalara to calculate taxes for the sales order then you can uncheck the "Send to Avalara" check box.

When Avalara Integration is enabled, all Sales Invoices will be sent to Avalara to calculate exact tax amounts per line when the Sales Invoice is released. While the Sales Invoice is a Draft or is being Revised, and estimate of the tax amount will be calculated using the tax rates that are set on the Tax tab for the document.

When you Release the Sales Invoice, a transaction will be created and saved in Avalara. These transactions will be used to report taxes to the various taxing jurisdictions where you have setup Nexus.

When you Revise a Sales Invoice, FOURA will check Avalara to make sure that the transaction has not been locked (reported to a taxing authority). If the transaction is not locked, then it will be un-committed in Avalara until you re-release the Sales Invoice in FOURA.

When you Cancel a Sales Invoice, FOURA will check Avalara to see if the transaction has been locked (reported to a taxing authority). If the transaction is not locked, then it will be updated to zero-out all values. If the transaction has been locked, then a reversing transaction will be created in Avalara with a document number of [Sales Invoice]-X. This reversing transaction will cancel out the original sales invoice in Avalara.

In FOURA, refunds are entered as Credit Memos or Return Invoices, which are just like a normal sales invoice (see above), but with a negative amount and negative tax.. In cases where you need to use a specific Tax Date that is different from the Credit Memo date then you can set the Tax Date on the Tax tab.

When Avalara is enabled, FOURA will use the following API Calls:

| API Call | FOURA Form | Action | Notes |

|---|---|---|---|

| Ping | Avalara Setup | Click Test Connection button | |

| ResolveAddressPost | Supplier Entry Add Supplier Customer Entry Add Customer Add Ship Tag Address Entry Add Address |

Click Avalara button | Ship-to addresses support coordinates Billing addresses are address only Only available for US and Canada addresses |

| TaxRatesByAddress | Sales Invoice Entry Sales Order Entry Quote Entry |

Click Avalara button on Tax tab | Sets document tax rates - free API call |

| CreateTransaction | Quote Entry Sales Order Entry |

Release | Calculates taxability and tax amounts per line Optional - you can uncheck the Avalara button on the release dialog |

| CreateOrAdjustTransaction | Sales Invoice Entry | Release, Cancel | Calculates taxability and tax amounts per line |

| GetTransactionByCode | Sales Invoice Entry | Revise, Cancel | Check Avalara transaction lock status |

| UncommitTransaction | Sales Invoice Entry | Revise | |

| QueryNexus | Country/State List | Click Avalara button | Sets FOURA Nexus dates per State/Region to match Avalara |